Let's fix some slides (the pitch deck edition)

Building Overslide S1, Ep 7: Why some slides aren't working, and what to do instead

Some founders will A/B test their landing page copy 47 times but present to investors with slides that look like they were made in PowerPoint 2003 (thanks Dave Chapelle).

A VC just passed on a friend's startup (sorry bud, you got this). The numbers were solid—great growth, strong retention, clear product-market fit. But the traction slide read like a grocery list instead of telling the story investors needed to hear.

This got me thinking (shocker). I've been working with a few pitch decks in my day and have come to believe that some founders look at slides as just information containers. Well, wrong. They're tools of persuasion. Each slide has one job: move your audience from skeptical to excited to ready to invest (or closer to closing the deal, if you're in sales).

But each industry is different. A FinTech traction slide should look nothing like a consumer app traction slide. Climate tech needs a completely different narrative than enterprise software. Same slide type, totally different approach.

So, in this episode, I'm breaking down four slides across four different startups to show you exactly what I mean (wanted to do 5 initially, ran out of time on the 5, had to improvise). Your mileage may vary, but following one or two of these points might come in handy in your next investor meeting.

These slides are: problem slides that bore instead of building urgency, traction slides that list instead of telling a story, market slides that confuse instead of excite and business model slides that resemble a price sheet instead of a user journey. Let's fix them.

Why most slides suck (and what actually works)

Let me be clear: this isn't just about making slides prettier. It's about making them more persuasive (Canva can make your slides prettier, but that doesn't mean they'll close the deal).

Your problem slide needs to create urgency. Your traction slide needs to build confidence. Your market slide needs to make them see dollar signs (or Euros, or gold-pressed latinum if you're a Ferengi... if you don't get the Star Trek reference, are we even friends!?).

The best slides focus on one thing instead of trying to say everything at once. But also, what that one thing should be depends entirely on your industry.

Quick disclaimer: The following startup names came from ChatGPT after I asked it to "make them sound innovative but not stupid." (we can see how that went). Any resemblance to real companies is purely coincidental, but if your startup is actually called ThrivePoint, I'm sorry, this is not about you. Cool name btw.

Also, while most people just want to make the slides look better, the focus needs to be on making them more effective. There's a difference.

1. ThrivePoint - Problem Slide (HR Tech)

Stop listing problems, start telling stories

Calling this slide boring is an understatement. It's a list of obvious problems that every HR person already knows. No investor looks at this and thinks "we need to solve this right fucking now."

Instead of bullet points, we tell Sarah's story:

"Sarah was Acme Corp's top performer. Then remote work happened."

We show her journey from crushing it to struggling with calendar overload, isolation, and the warning signs her manager completely missed. When Sarah quits, Acme loses $150K in replacement costs and six months of knowledge.

Then we hit them with the scale: "1 in 4 remote workers quit due to isolation"

Why this doesn't suck:

Personal stories create an emotional connection that statistics can't match

Concrete consequences ($150K, six months) make the problem feel real

The scale reveals that individual pain transforms into a massive market opportunity, 1 in 4.

HR investors can immediately picture this happening to their own teams

2. PayFlow - Traction Slide (FinTech)

Turn your metrics into a growth story

Every number gets equal treatment, so nothing stands out. There's no story about why this growth matters or what it proves about the business. It's just data thrown at the screen (at least it's not a spreadsheet).

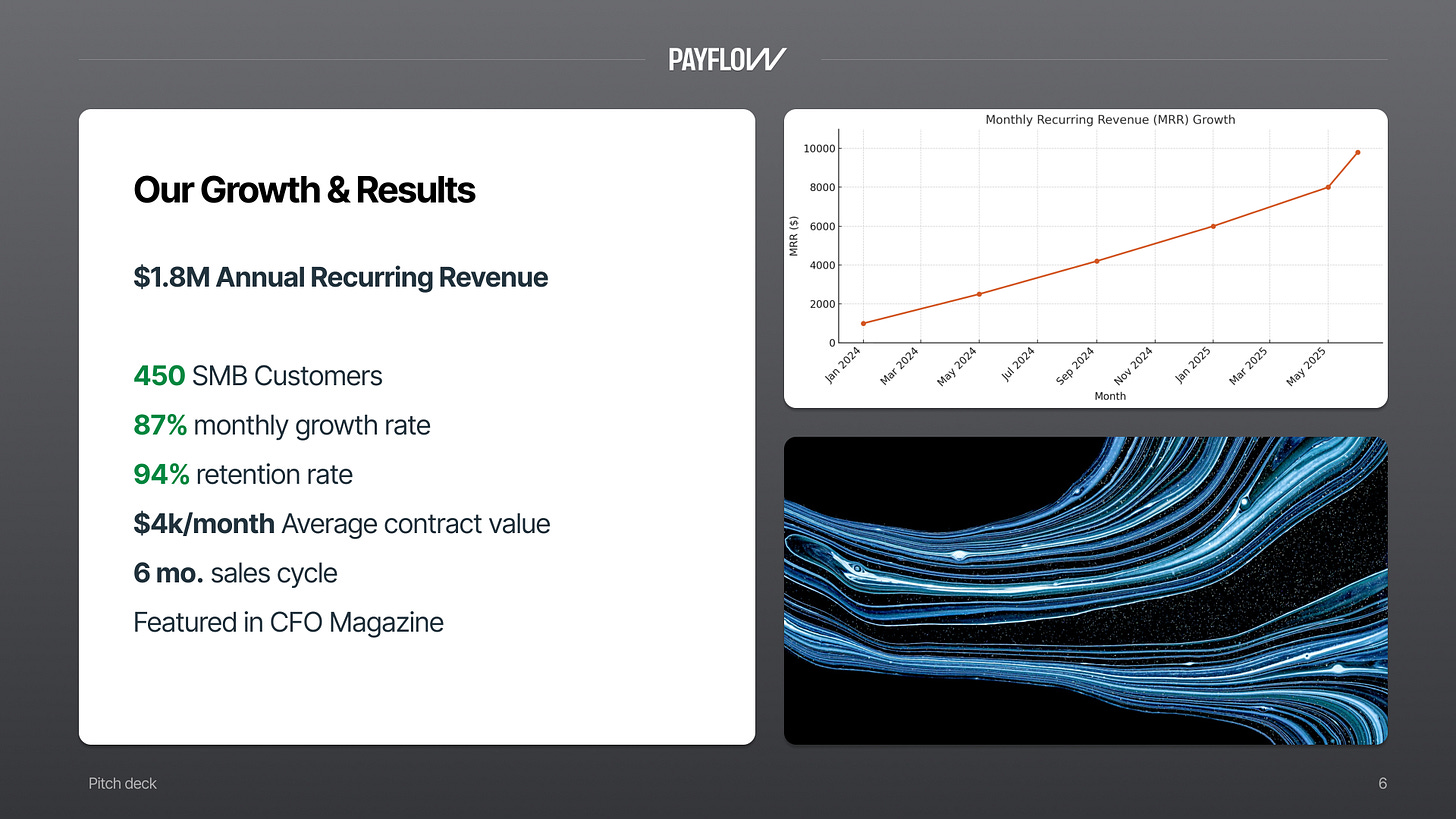

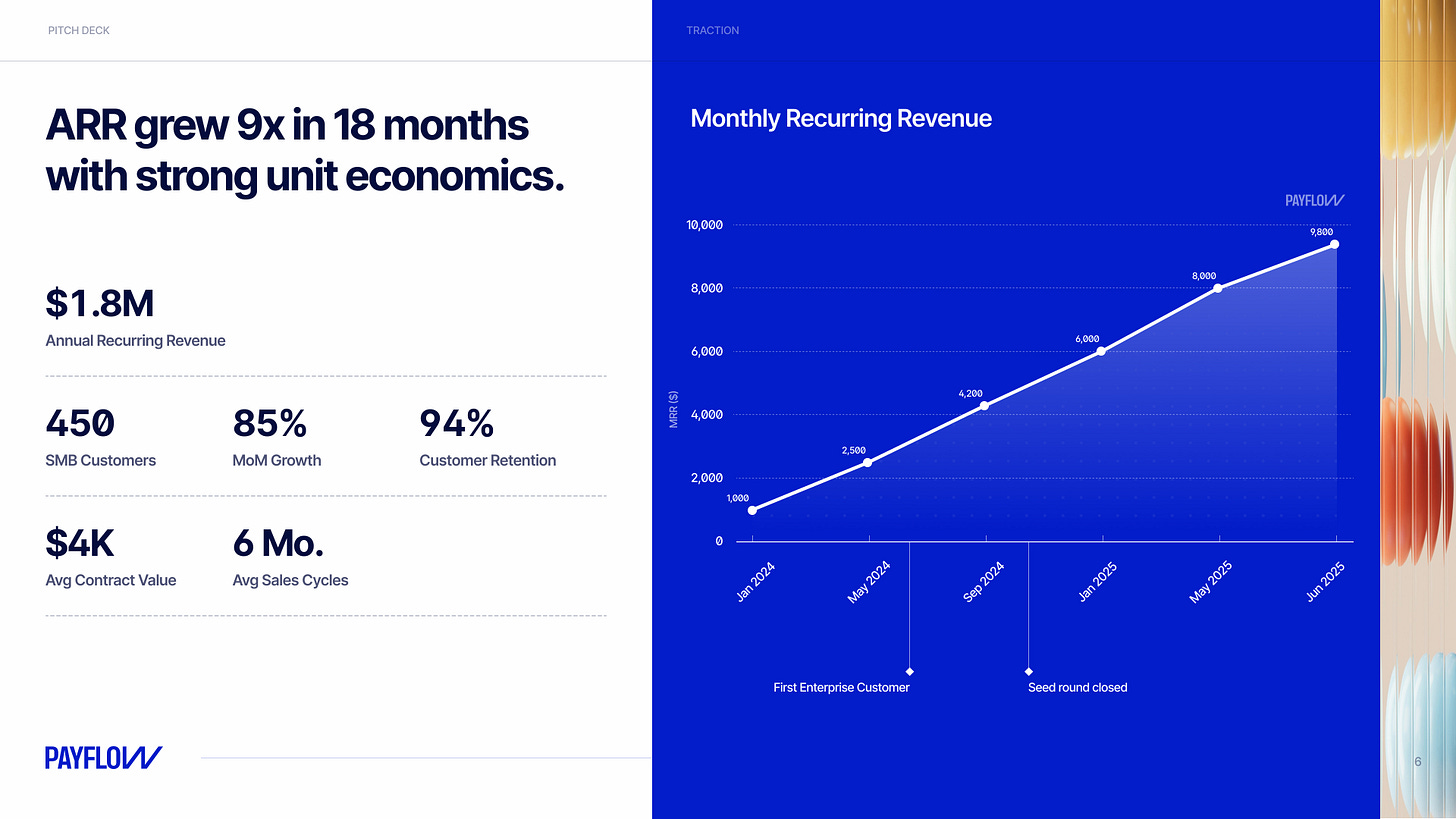

We lead with a clean timeline showing revenue growth from $200K to $1.8M over 18 months. Key milestones are marked. Below that, the metrics that prove this isn't just a sugar high: 94% retention, $4K ACV, decreasing customer acquisition cost.

The narrative hierarchy is crystal clear: growth story first, unit economics second, everything else supporting.

Here's the thing that makes this work even better: the slide headline should summarize the key insight, just like McKinsey and other top consulting firms do. Instead of "Our Traction" or "Growth Metrics," try "ARR grew 9x in 18 months with strong unit economics." Your headline becomes the takeaway, and the visuals prove it.

And here's the reality about perfecting slides: you never really stop. You refine after every investor meeting, every sales call, every piece of feedback. The slide evolution usually pauses when funding money hits your bank account... until you start prepping for the next round.

Why FinTech investors don't hate this:

The growth narrative is immediately more compelling

Unit economics prove sustainable growth (94% retention and $4K ACV are solid benchmarks)

The story structure builds credibility with financial audiences

Data tells a story instead of just sitting there

3. CarbonCure - Market Opportunity (Climate Tech)

Make big numbers actually mean something

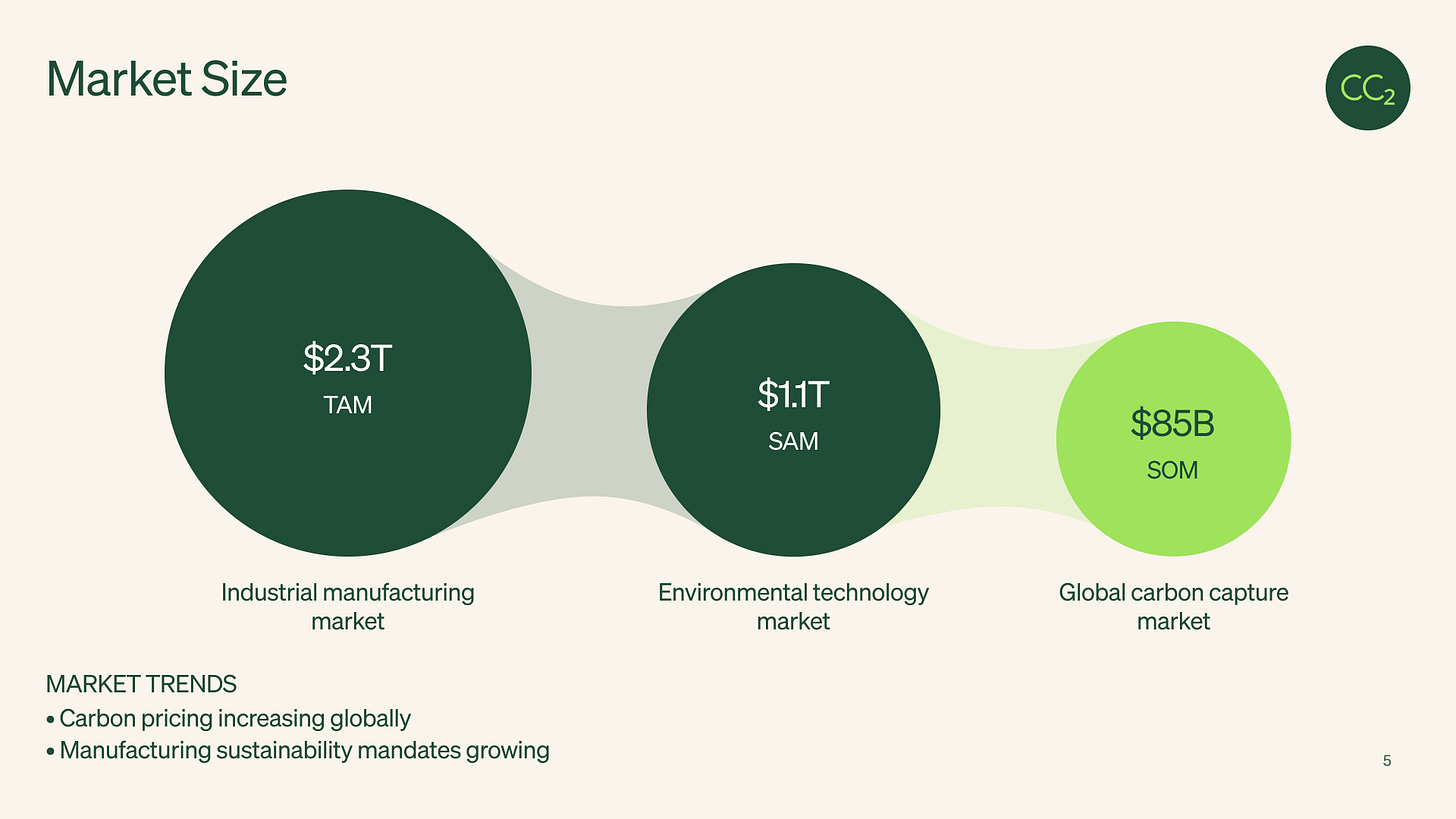

Big numbers without context are useless. This tells investors the market is large but doesn't explain why CarbonCure can win or why this moment matters.

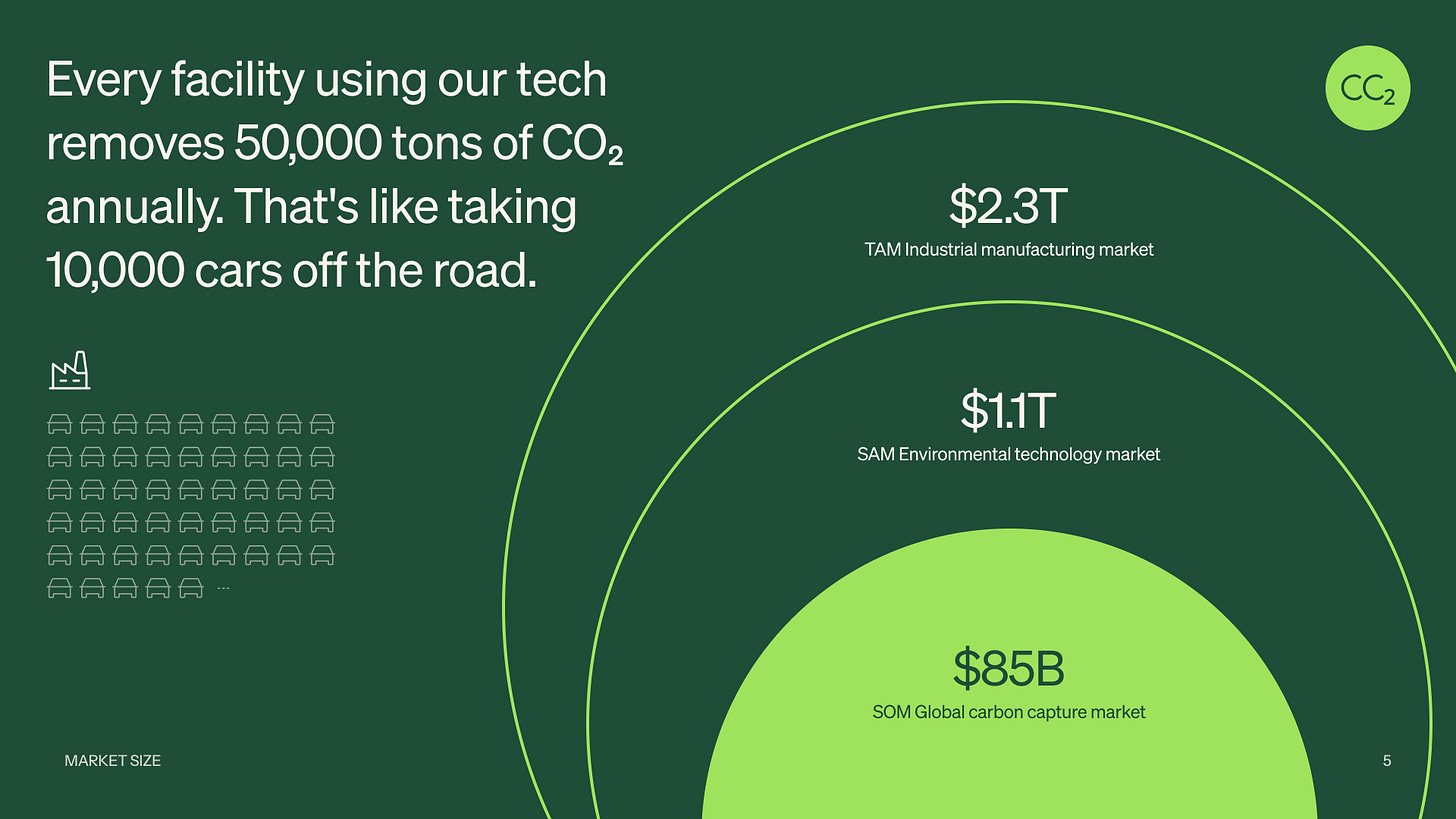

We start with what matters: "Every facility using our tech removes 50,000 tons of CO2 annually. That's like taking 10,000 cars off the road."

Then we show the market transformation with manufacturing facilities worldwide, adoption waves driven by regulation and corporate commitments. The $85B carbon market sits within $2T of manufacturing transformation spend.

Climate investors want to save the world first, make money second (haha). Lead with impact, not market size.

Why climate investors actually care:

Impact narrative comes before market size - they need to believe in the mission first

Market timing is woven into the story (regulatory pressure creates urgency)

The ambitious narrative matches the transformative potential they're looking for

Context makes $85B meaningful rather than just another big number

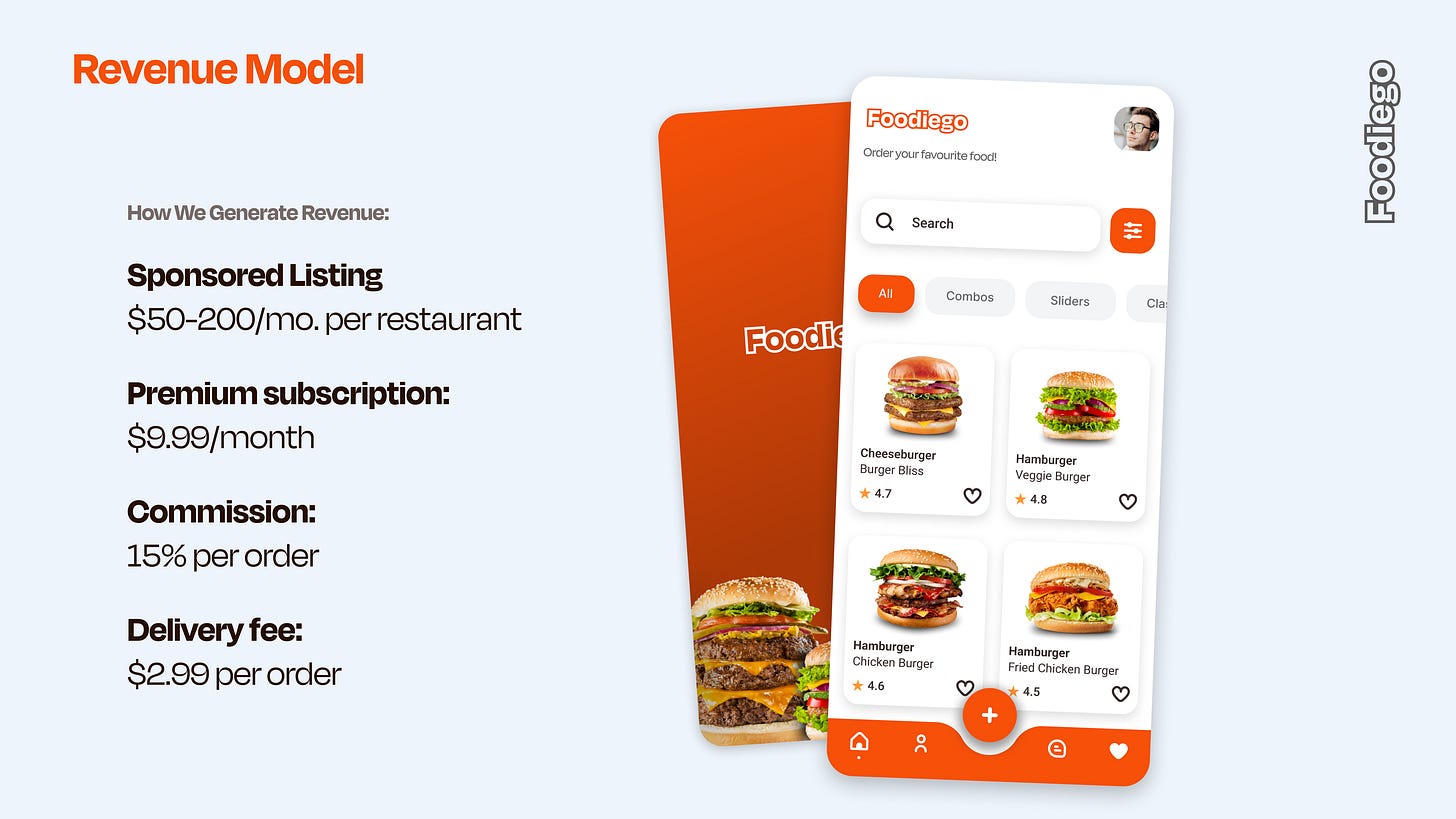

4. FoodieGo - Business Model (Consumer App)

Revenue should feel natural, not forced

This reads like a pricing sheet, not a business model. Consumer investors think in user behavior, not revenue streams.

We map a typical day with FoodieGo (awesome name btw…): discovering restaurants (sponsored listings revenue), reading premium reviews (subscription conversion), ordering delivery (commission), sharing experiences (viral growth).

Each step shows how revenue flows naturally from user behavior, with metrics proving it works. (Consumer apps should aim for 3%+ conversion from free to paid, anything less and investors start worrying about monetization.)

The user journey narrative feels organic rather than forced because it follows how people actually behave.

Why consumer VCs dig this:

User journey narrative shows natural conversion rather than forced monetization

Revenue feels organic because it follows actual user behavior patterns

The story structure appeals to consumer-focused investors

Network effects emerge naturally from the narrative flow

What makes all of these not suck

Or, the takeaway from this article.

Start with your audience: HR tech investors need emotional connection through personal stories. FinTech investors need data credibility through growth narratives. Match your storytelling approach to their expectations.

Industry narrative languages matter: Consumer needs behavior-driven user journeys. Climate needs impact-first mission narratives.

Story beats features every fucking time: Lead with narratives, not what you built.

One clear message per slide: Don't try to say everything at once. Each slide should advance your story one clear step.

And now, a quick shameless plug

Got issues with your current decks? I work with founders who know their idea is solid but need help telling that story without boring people to death.

Check out my sales deck for the complete process and transparent pricing. Or book a 15-min call if you want to chat about your specific deck disasters.

Your idea deserves slides that don't suck.

Catch you in the next one

-Max

PS. If you find this useful, ping me and I'll do more of these.